P2E Crypto Tax Rules

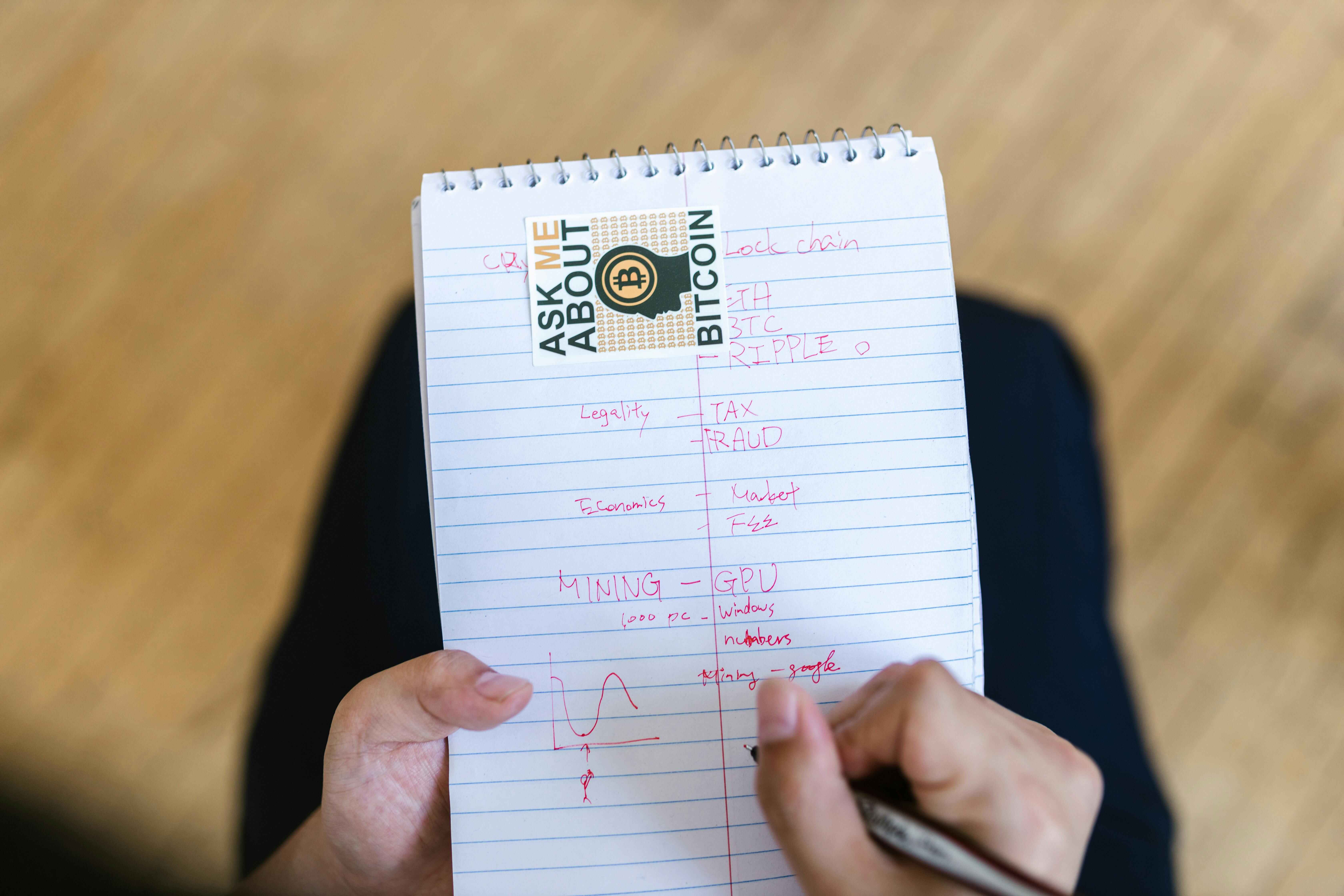

Introduction

Play to earn crypto games created a new category of economic activity. What began as digital entertainment quickly evolved into a system where players generate measurable, taxable value through gameplay, strategy, and digital asset management. Tokens accumulate in wallets, NFTs appreciate or collapse, and items crafted in a virtual world can be sold to global markets in minutes.

The tax system does not view these activities as optional or experimental. It views them as income.

The challenge is not that P2E ecosystems generate tax events. The challenge is that they generate them constantly, across multiple chains, with values that shift by the hour, and with mechanics that were never designed for accounting. To report P2E income correctly, taxpayers must reconstruct an economic story from fragmented blockchain data, volatile token markets, and game based reward systems that operate continuously in the background.

Why P2E Rewards Are Treated as Taxable Income

P2E games reward players with tokens, NFTs, or in game items that carry objective market value. Once an asset has value and the player receives it, tax rules classify it as income.

This is not tied to whether the player sells the asset. It is tied to the moment the player obtains something that can be exchanged for value.

Authorities classify most P2E earnings as ordinary income because the player actively works to obtain them through gameplay, tasks, or skill based activity. The distinction is important because income is taxed differently than capital gains.

Understanding the Dual Layer of Taxation in P2E Systems

P2E activity creates two separate tax layers that must be understood clearly.

The first layer is income at the moment the asset is earned.

The second layer is capital gain or loss when the asset is used, sold, or swapped.

This dual system means that one token can generate multiple taxable events during its lifecycle.

A player may earn a token at a low value, hold it during a surge, and then swap it later at a lower price. This sequence creates income and either a gain or a loss depending on market conditions. Without proper chronological records, these events become impossible to rebuild accurately.

Valuation at the Moment of Earning

P2E earnings often occur in small, continuous increments. Games reward tokens per minute, per action, per battle, or per objective.

Each reward must be valued at the moment the player receives it. This requires fair market value for each unit of the token at the timestamp of receipt.

In volatile crypto markets, this value can shift significantly throughout a single day. For active players, the difference between accurate and approximate valuation may create large discrepancies in reported income.

The difficulty is not that valuation is conceptually complex. The difficulty is operational. P2E rewards can involve hundreds or thousands of microtransactions. Reconstructing value after the fact is extremely difficult without careful tracking.

NFTs, Crafted Items, and Digital Assets as Taxable Property

Many P2E ecosystems allow players to craft items, earn character upgrades, or collect NFTs with market value.

Tax rules classify these as property.

If an item is earned, its fair market value at the time of acquisition is income.

When the item is later sold, traded, or upgraded through a taxable event, any change in value becomes a capital gain or loss.

This applies even if the item never leaves the game but can be sold inside its marketplace. P2E games created a crossover where gameplay and digital commerce overlap. That overlap is where tax obligations arise.

When P2E Activity Becomes Business Income

Some players treat P2E gaming as a structured economic activity rather than casual gameplay.

Patterns that may convert P2E activity into business income include:

- playing systematically to generate predictable rewards

- managing multiple accounts or scholar programs

- selling crafted items at scale

- maintaining spreadsheets or business processes

- offering coaching, asset rentals, or guild management services

Business income classification affects deductions, self employment tax, and reporting obligations. This distinction becomes important when income grows beyond hobby level activity.

The Complexity of Cross Chain Transactions in P2E

Many P2E ecosystems operate across several blockchains. Tokens may need to be bridged to another chain for liquidity, staking, or use within another game function.

A bridge transfer is generally not a sale, but it is a change in how the asset is represented.

Cost basis must be carried forward. Fees paid in the native token of the chain must be tracked.

Multiple blockchains produce multiple records with different structures and timestamp systems.

Without careful linking of transaction hashes, a chain of custody is lost, and the taxpayer may appear to have sold assets when they merely moved them.

Recordkeeping as the Foundation of Compliance

P2E activity produces data at a scale that exceeds most traditional accounting systems.

Wallets fill with small reward amounts. Gas fees accumulate. Marketplace interactions create sporadic valuation spikes.

Authorities expect full reporting regardless of complexity.

Effective recordkeeping requires:

- a complete transaction history for each wallet

- valuation data for each reward

- cost basis tracking for NFTs and items

- timestamp aligned logs for all cross chain activity

- market price data tied to specific moments of receipt

- clear evidence of gains and losses for each disposal

This level of detail is burdensome but necessary. Without it, taxpayers cannot explain their reported income during an audit.

Handling Losses in a Volatile Gaming Economy

Crypto markets create rapid cycles of gains and losses.

Players may earn large values during peak periods and face steep declines later.

Losses can offset gains, reducing tax exposure, but only if they are documented properly.

Many players misunderstand this point.

Losses are not recognized when a token loses market value. They are recognized only when the asset is disposed of.

This distinction determines whether a taxpayer can reduce their tax liability.

The Psychological Burden of P2E Tax Reporting

Gameplay feels simple because the mechanics are designed for engagement. Tax reporting feels overwhelming because the financial structure behind P2E ecosystems is fragmented and volatile.

Many players experience stress because they do not understand how much activity has accumulated until tax season arrives.

The emotional burden often leads to avoidance, which creates even larger compliance problems.

The solution is not to simplify the game. The solution is to adopt a financial mindset early, before the data becomes unmanageable.

Conclusion

P2E crypto games operate at the intersection of entertainment and real economic value. Tax authorities treat these environments as income generating ecosystems, and the responsibility to report accurately falls entirely on the player. Tokens, NFTs, and digital rewards create tax obligations the moment they are earned. The volatility and complexity of these systems do not change that.

Players who maintain detailed records, track valuation correctly, and understand the dual nature of P2E taxation can manage their obligations with clarity. Those who delay face increasing risk as tax authorities pay closer attention to digital asset ecosystems.

Tax Partners can assist you in understanding how P2E income is taxed, tracking your digital asset activity, and preparing accurate reports in an environment defined by constant movement and rapid market changes.

This article is written for educational purposes.

Should you have any inquiries, please do not hesitate to contact us at (905) 836-8755, via email at info@taxpartners.ca, or by visiting our website at www.taxpartners.ca.

Tax Partners has been operational since 1981 and is recognized as one of the leading tax and accounting firms in North America. Contact us today for a FREE initial consultation appointment.