How to Handle Taxation on Foreign Rental Income

Owning rental property in a foreign country can be a lucrative investment, but it comes with tax obl...

Read More

Tax Deductions Available for Freelancers and Independent Contractors

Freelancers and independent contractors in Canada and the U.S. are considered self-employed, meaning...

Read More

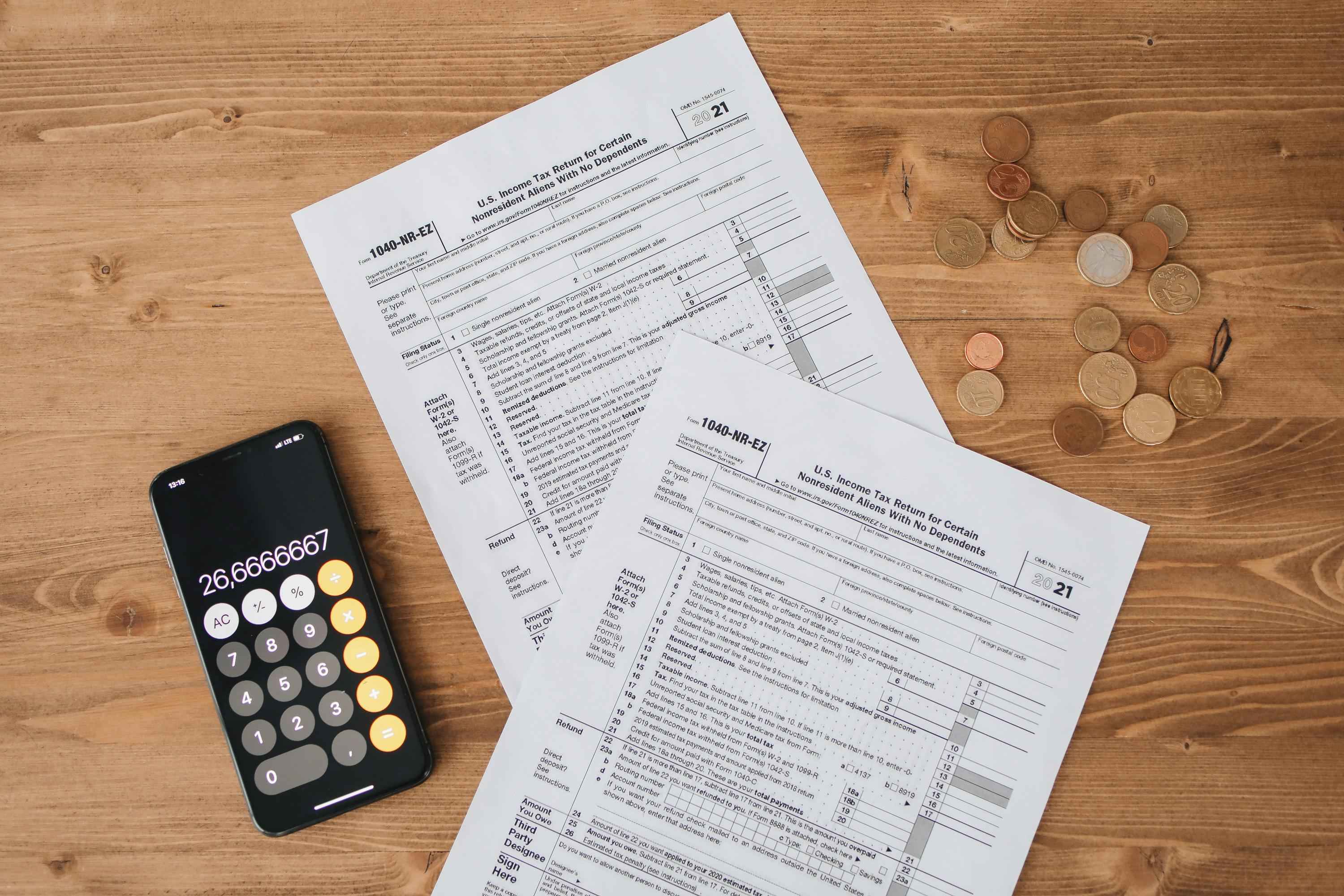

How to File a Foreign Trust Report (IRS Form 3520)

U.S. taxpayers who have financial interests in a foreign trust or receive large gifts from foreign i...

Read More

Tax Benefits for Small Business Owners in Canada

Small business owners in Canada have access to several tax benefits, deductions, and credits that he...

Read More

How the Principal Residence Exemption Works for Canadian Homeowners

The Principal Residence Exemption (PRE) is a tax benefit available to Canadian homeowners that allow...

Read More

The Complete Guide to RRSP Withdrawals and Their Tax Impact

The Registered Retirement Savings Plan (RRSP) is a tax-advantaged savings vehicle for Canadians, des...

Read More

March 26, 2025

March 26, 2025